What's New?

Enjoy all the features you know & love in your current digital banking experience, plus a few new bells & whistles designed to make your financial life easier:

Initiate Wire Transfers

Initiate one-time wires and manage wire templates. Enjoy increased security with dual-control approvals.

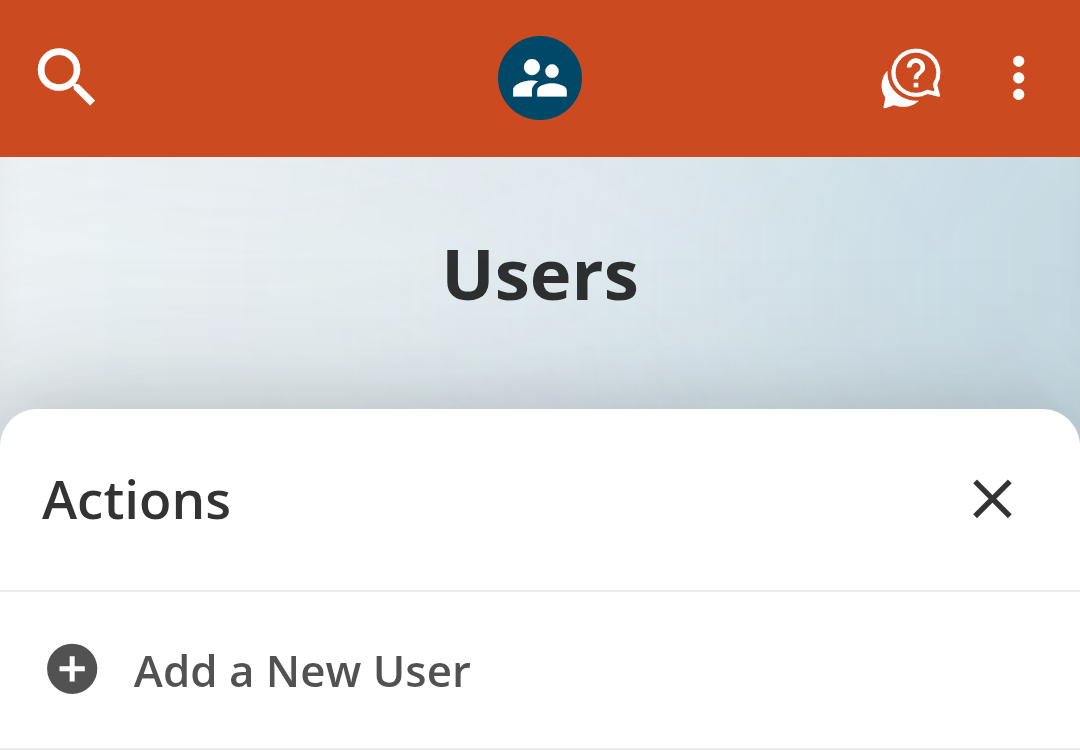

Custom User Roles

Create Roles that allow users to only see and do what you want. Specify permissions based on accounts, transfers, ACH, wires, and more!

Monitor User Activity

Gain insight into how authorized Users interact with your account for greater visibility into your finances.

Custom Dashboard Features

Customize how you view accounts and features on your dashboard. Plus, Task Center highlights money movement that needs immediate attention.

Track Spending Habits

Tag transactions to help keep track of spending, and create customized reports to monitor financial activity.

Banco en español o inglés

¡Cambia entre español e inglés con sólo un clic! Switch between Spanish and English with just one click!

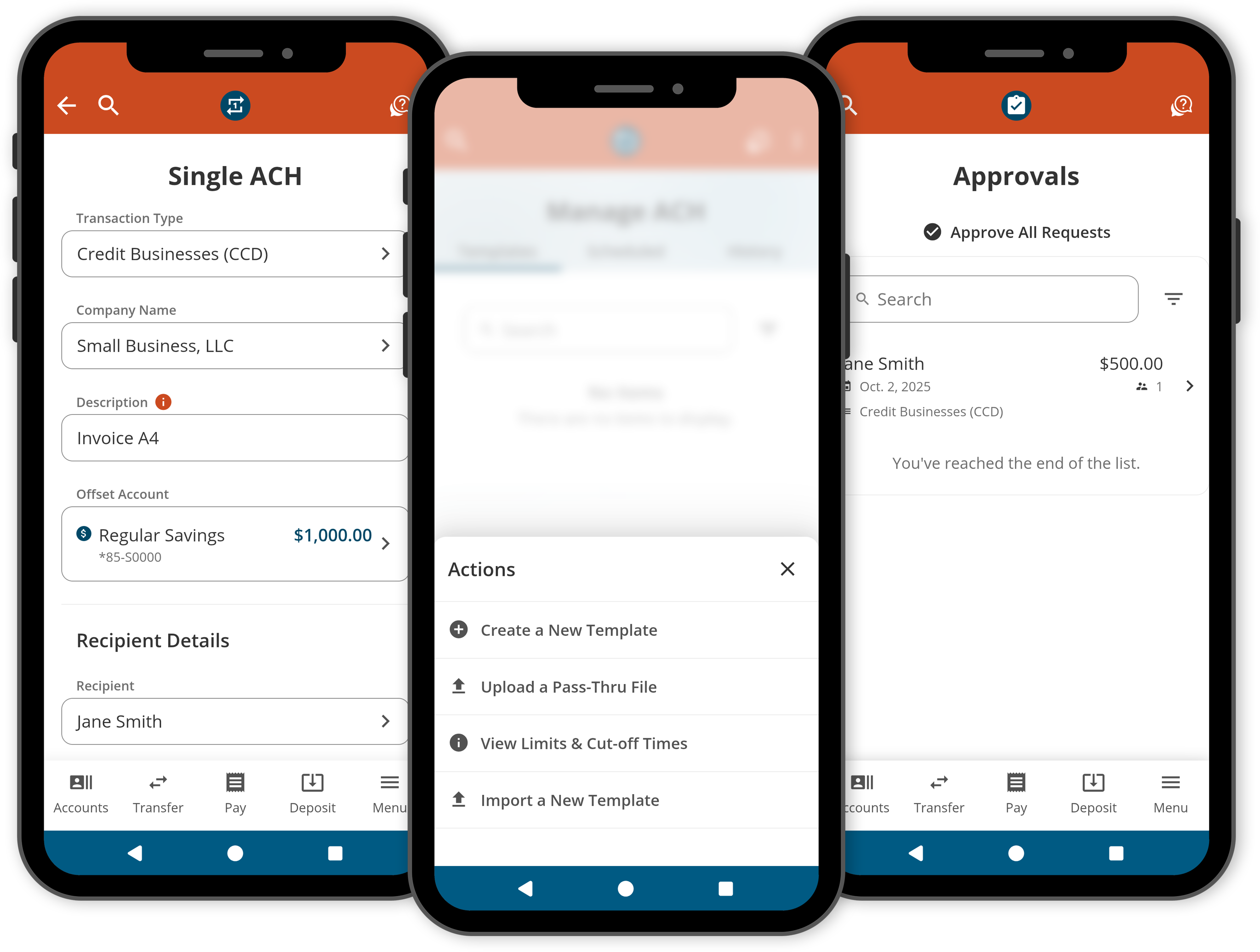

ACH Upgrades

ACH Pre-Funding

With ACH pre-funding, your business will have enhanced payment reliability and reduced risk of returned transactions. Welcome to streamlined transaction processing!

Dual Control ACH Approval

Enjoy and added layer of security by requiring two individuals to approve transactions before they are executed. This minimizes the risk of fraud and errors, protecting your hard earned dollars.

ACH Templates

Templates allow you to predefine recurring transactions, such as payroll or vendor payments, saving time and reducing the potential for errors during data entry. Templates also speed up record reconciliation, saving you even more time!

Plan Ahead

There are a few things you can do now to make your digital upgrade as seamless as possible:

Familiarize yourself with the registration process.

- All business accounts will need to be re-registered to gain access to the enhanced business experience.

- Only one authorized user on the business account should complete this registration process. This user will be considered the "primary user" and will be able to add additional users with custom permissions from the account dashboard.

- If you have multiple business accounts at FCCU, you will need to complete this registration process to create login credentials for each individual business account.

Plan ahead for limited availability:

Online & Mobile Banking

On October 20 at 7:00 am CT, digital banking will be down for maintenance and unavailable to users. We anticipate a smooth upgrade and availability the next day, October 21!

Update 10/21: Our digital banking upgrade is live and available to users!

Online Bill Pay

Starting on October 20, users will not have access to manage their bill pay account for 1-3 business days. Any bill payments scheduled to go out during this period will be posted without disruption.

Update 10/21: Our digital banking upgrade is live and bill pay is available to users!

Mobile Check Deposit

Starting on October 20, users will not have access to mobile check deposit for 1-2 business days.

Update 10/21: Our digital banking upgrade is live and mobile check deposit is available to users!

Quicken® and QuickBooks®

Intuit aggregation services may be interrupted starting on October 20 for up to 3-5 business days. Users are encouraged to download a QFX/QBO file during this outage. The following services may not work during the outage:

- Quicken Win/Mac Express Web Connect

- QuickBooks Online Express Web Connect

Have the following info ready to verify:

- Employer Identification Number (EIN)

- FCCU account number for your business account

- Primary user’s Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

Double check we have the right contact info on file for your business.

The first time you log in, you will be asked to verify a security code sent to an email or phone number we have on file for you. If your contact info is missing or outdated, you'll have to contact us before logging in for the first time.

You can update your contact info in Profile Settings within Online & Mobile Banking.

Attention  Quicken and

Quicken and  QuickBooks Users

QuickBooks Users

This upgrade will require that you make changes to your QuickBooks or Quicken software. Please read the conversion instructions and corresponding action dates to ensure a smooth transition.

1st Action Date: October 19, 2025

A data file backup and a final transaction download should be completed by this date. Please make sure to complete the final download before this date since transaction history might not be available after the upgrade.

2nd Action Date: October 21, 2025

This is the action date for the remaining steps on the conversion instructions. You will complete the deactivate/reactivate of your online banking connection to ensure that you get your current Quicken or QuickBooks accounts set up with the new connection.

Intuit aggregation services may be interrupted starting on October 20 for up to 3-5 business days. Users are encouraged to download a QFX/QBO file during this outage. The following services may not work during the outage: Quicken Win/Mac Express Web Connect, QuickBooks Online Express Web Connect

Detailed Conversion Instructions

Get Started

#1 Navigate to Digital Banking

Online Banking

Online Banking

From a browser, navigate to the digital banking login page by clicking the blue Online Banking button at the top right of any page on our website.

Mobile Banking

Mobile Banking

![]() iOS iPhone Users

iOS iPhone Users

Keep your existing FCCU Mobile App and update to the newest version of the app.

![]() Android Users

Android Users

Delete your existing FCCU Mobile Banking App and download the new FCCU Mobile App from the Google Play Store.

#2 Register as a New User

Business Users

Business Users

Click the Or, Register with Online Banking button. Follow the prompts to verify your identity (via email or text) and make a username and password.

IMPORTANT:

IMPORTANT:

- All business accounts will need to be re-registered to gain access to the enhanced business experience.

- Only one authorized user on the business account should complete this registration process. This user will be considered the "primary user" and will be able to add additional users with custom permissions from the account dashboard.

- If you have multiple business accounts at FCCU, you will need to complete this registration process to create login credentials for each individual business account.

#3 What To Do First

Here's a list of things we think you should check out first: from settings you'll need to reset to new features to discover!

Create Custom Roles & Add Additional Users

Add additional Users to your business account while maintaining account security, minimizing financial risk, and establishing strong checks and balances.

For example, you may want to extend digital banking access to your accounting team to manage payroll transfers, pay bills, etc. Simply create a new Role with permissions based on accounts, transfers, ACH, wires, and more, and then add individuals as a new User.

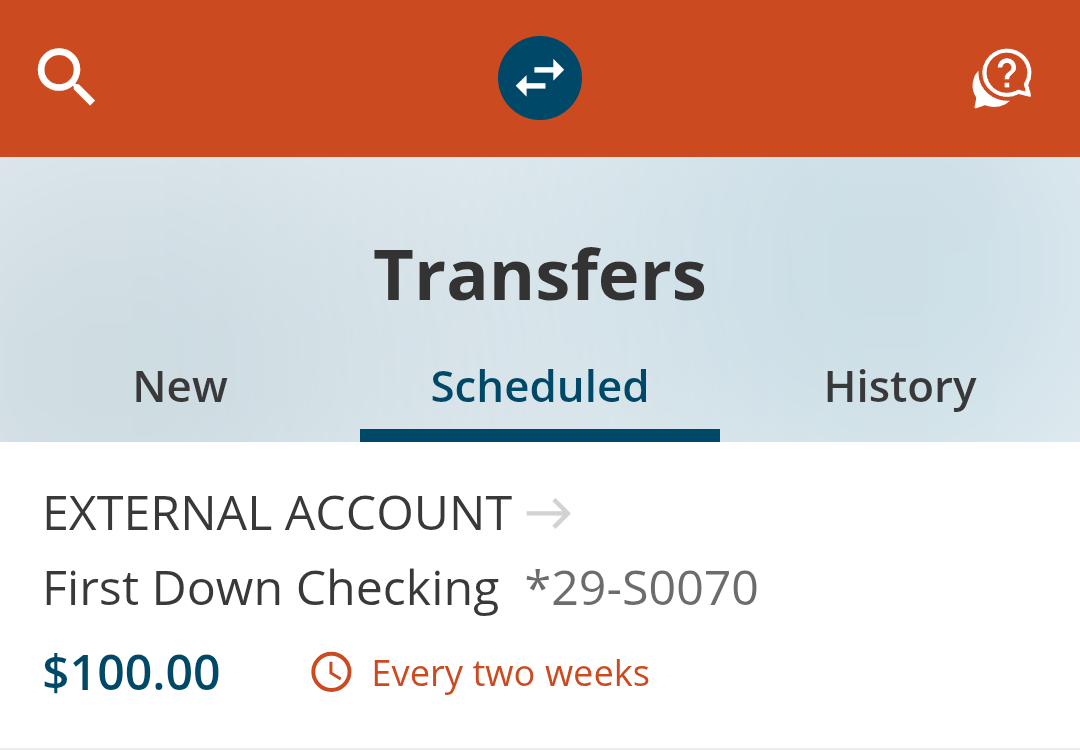

Double Check Your External Accounts & Transfers

Your External Accounts and scheduled transfers should carryover, but we still encourage you to ensure that they are still set up properly after the upgrade.

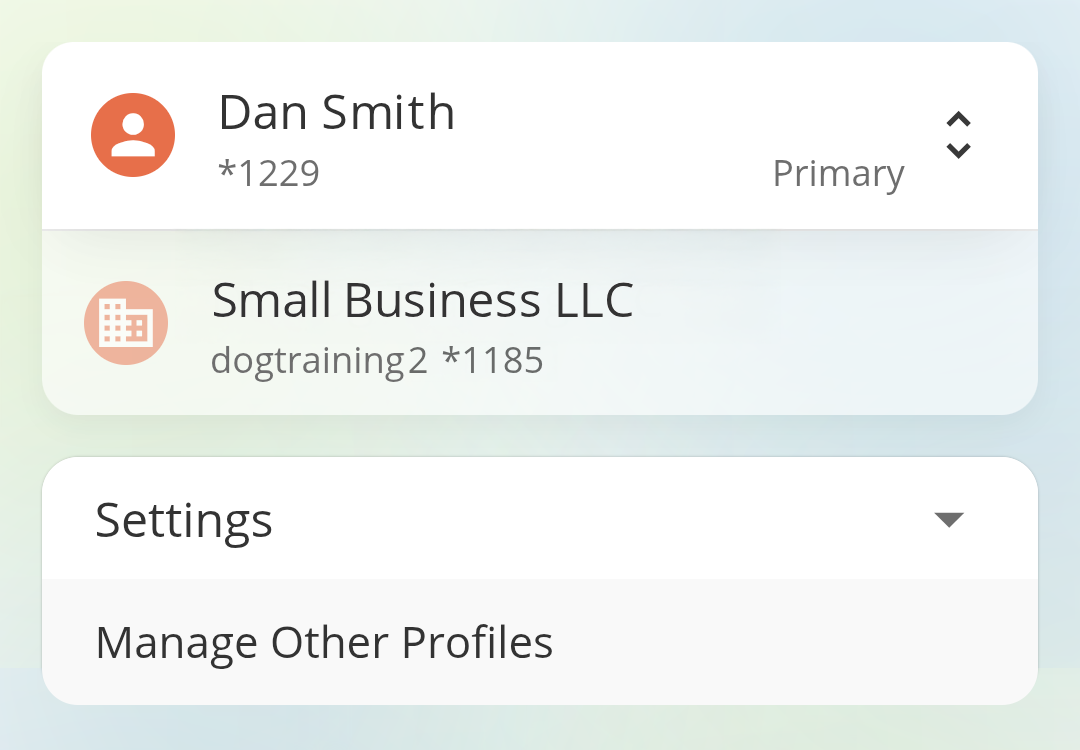

Add Business Profile to Personal Account

Easily switch between your personal and business accounts without having to log in and out. Within settings, click the Manage Other Profiles option and follow the instructions.

Step-by-step instructions coming soon!

Frequently Asked Questions (FAQs)

Business Digital Banking Upgrade | Last updated on 10/22/2025

{beginAccordion}

Why are you making this change?

{openTab}

Simply put, we’re making digital banking at FCCU better. We’re introducing a ton of amazing features like savings goal tracking, in-app budgeting, account consolidation— so you can manage all your accounts in one place, even if they aren’t accounts at FCCU, and more!

We also received a lot of feedback from our business users about features they’d like to see to make managing their business accounts easier. We took those to heart and added a ton of things they have been wanting.

{endAccordion}

{beginAccordion}

When is the upgrade going to happen?

The digital banking upgrade will happen between October 20-23. On October 20 at 7:00 am CT, digital banking will be down for maintenance and unavailable to users. We anticipate a smooth upgrade and availability the next day, October 21!

Make sure your email on file is up-to-date because we will send you an email as soon as you can access the new digital banking upgrade!

{endAccordion}

{beginAccordion}

Do I need to do anything right now to prepare for the upgrade?

There are a few things you can do now to make your digital upgrade as seamless as possible:

Have the following info ready to verify:

- Employer Identification Number (EIN)

- FCCU account number for your business account

- Primary user’s Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

Double check we have the right contact info on file for your business.

The first time you log in, you will be asked to verify a security code sent to an email or phone number we have on file for you. If your contact info is missing or outdated, you'll have to contact us before logging in for the first time.

You can update your contact info in Profile Settings within Online & Mobile Banking.

Familiarize yourself with the registration process.

- All business accounts will need to be re-registered to gain access to the enhanced business experience.

- Only one authorized user on the business account should complete this registration process. This user will be considered the "primary user" and will be able to add additional users with custom permissions from the account dashboard.

- If you have multiple business accounts at FCCU, you will need to complete this registration process to create login credentials for each individual business account.

{endAccordion}

{beginAccordion}

Will there be any service interruptions?

Almost all our digital banking features will be unaffected. Select features will have limited availability as we upgrade our internal systems:

- Online & Mobile Banking

On October 20 at 7:00 am CT, digital banking will be down for maintenance and unavailable to users. We anticipate a smooth upgrade and availability the next day, October 21! Update 10/21: Our digital banking upgrade is live and available to users! - Online Bill Pay

Starting on October 20, users will not have access to manage their bill pay account for 1-3 business days. Any bill payments scheduled to go out during this period will be posted without disruption. Update 10/21: Our digital banking upgrade is live and bill pay is available to users! - Mobile Check Deposit

Starting on October 20, users will not have access to mobile check deposit for 1-2 business days. Update 10/21: Our digital banking upgrade is live and mobile check deposit is available to users! - Quicken® and QuickBooks®

Intuit aggregation services may be interrupted starting on October 20 for up to 3-5 business days. Users are encouraged to download a QFX/QBO file during this outage. - The following services may not work during the outage:

- Quicken Win/Mac Express Web Connect

- QuickBooks Online Express Web Connect

- See more important Quicken and QuickBooks info ⇒

{endAccordion}

{beginAccordion}

How do I get the new mobile app?

iOS iPhone Users

Keep your existing FCCU Mobile App and update to the newest version of the app.

Android Users

Delete your existing FCCU Mobile Banking App and download the new FCCU Mobile App from the Google Play Store.

{endAccordion}

{beginAccordion}

How do I know if I have the right mobile app?

The upgraded version of the mobile app will have this new app icon!

If your FCCU Mobile App has a different icon, delete the app and download the newest app from the Google Play or App Store. We will add the Google Play Store link here after the upgrade is live!

{endAccordion}

{beginAccordion}

Will my external transfers still work?

External transfers to other financial institutions should still appear in your upgraded app and online banking. When you log in for the first time, please verify that everything still appears properly.

{endAccordion}

Step-By-Step Instructions

Click the links below to view step-by-step instructions in a new browser tab. | Last updated on 10/24/2025