What's New?

This October, we gave our digital banking platform a face lift! Enjoy all the features you know and love in your current digital banking experience, plus a few new bells and whistles designed to make your financial life easier:

Initiate Wire Transfers

Initiate one-time wires and manage wire templates. Enjoy increased security with dual-control approvals.

Custom User Roles

Create Roles that allow users to only see and do what you want. Specify permissions based on accounts, transfers, ACH, wires, and more!

Monitor User Activity

Gain insight into how authorized Users interact with your account for greater visibility into your finances.

Custom Dashboard Features

Customize how you view accounts and features on your dashboard. Plus, Task Center highlights money movement that needs immediate attention.

Track Spending Habits

Tag transactions to help keep track of spending, and create customized reports to monitor financial activity.

Banco en español o inglés

¡Cambia entre español e inglés con sólo un clic! Switch between Spanish and English with just one click!

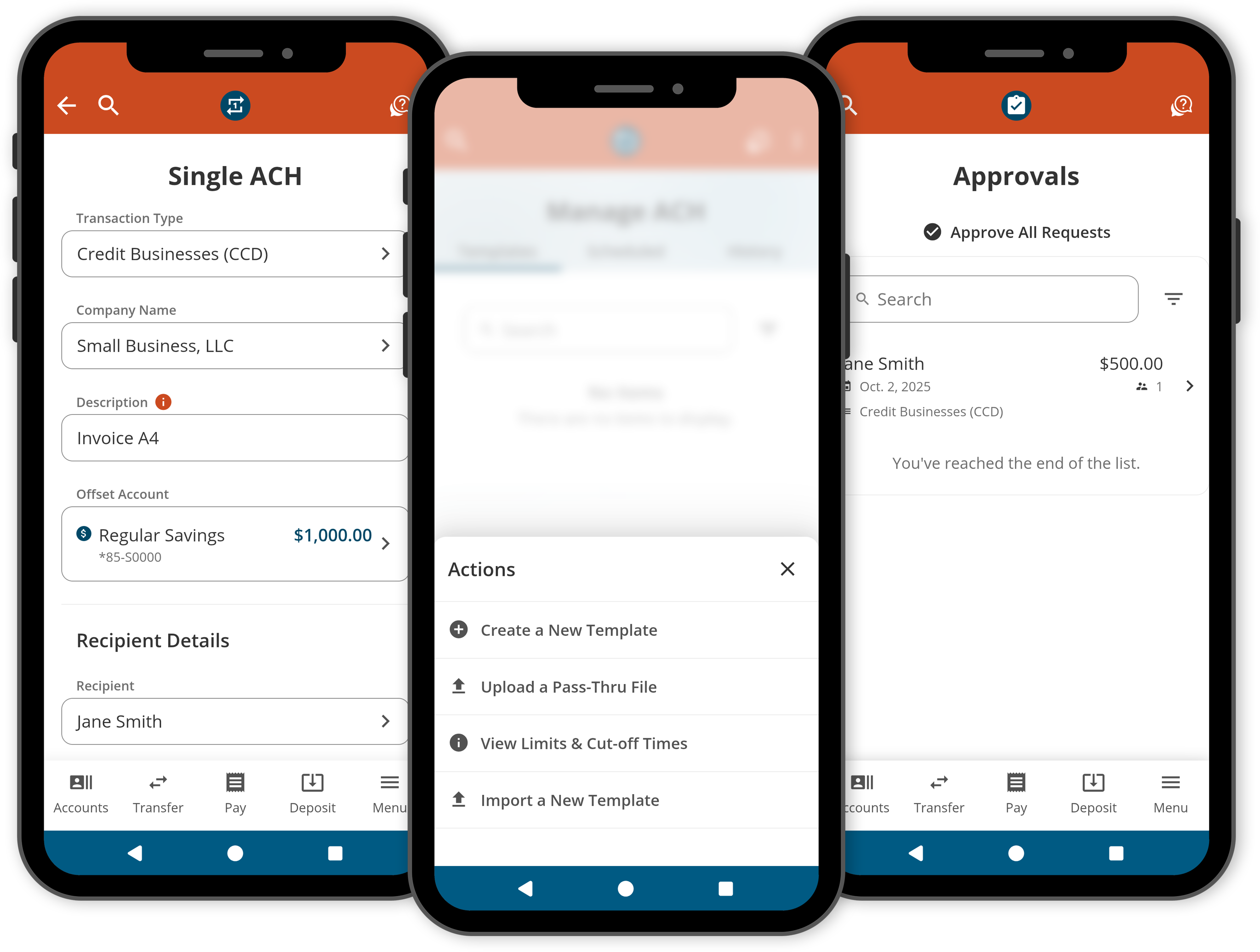

ACH Upgrades

ACH Pre-Funding

With ACH pre-funding, your business will have enhanced payment reliability and reduced risk of returned transactions. Welcome to streamlined transaction processing!

Dual Control ACH Approval

Enjoy and added layer of security by requiring two individuals to approve transactions before they are executed. This minimizes the risk of fraud and errors, protecting your hard earned dollars.

ACH Templates

Templates allow you to predefine recurring transactions, such as payroll or vendor payments, saving time and reducing the potential for errors during data entry. Templates also speed up record reconciliation, saving you even more time!

Core Features

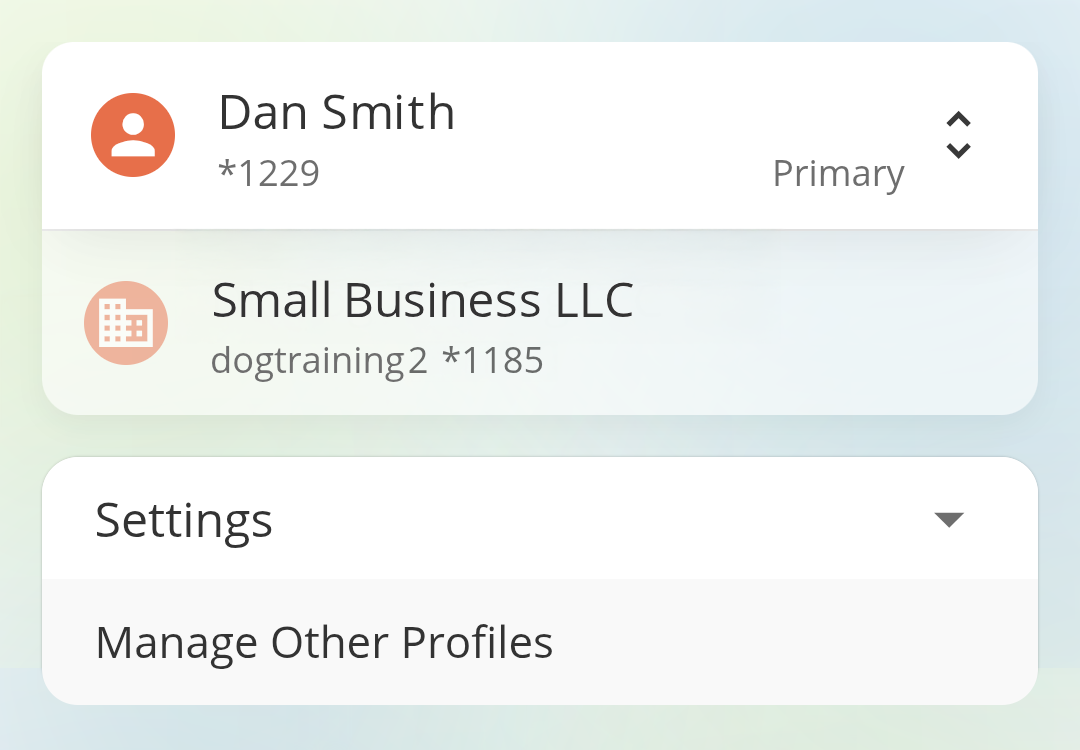

Switch Between Accounts

Switch Between Accounts

Keep your business and personal finances separate and toggle back and forth.

QuickBooks® Integration

QuickBooks® Integration

Export your transaction data to a .QBX file to import into Intuit® QuickBooks.

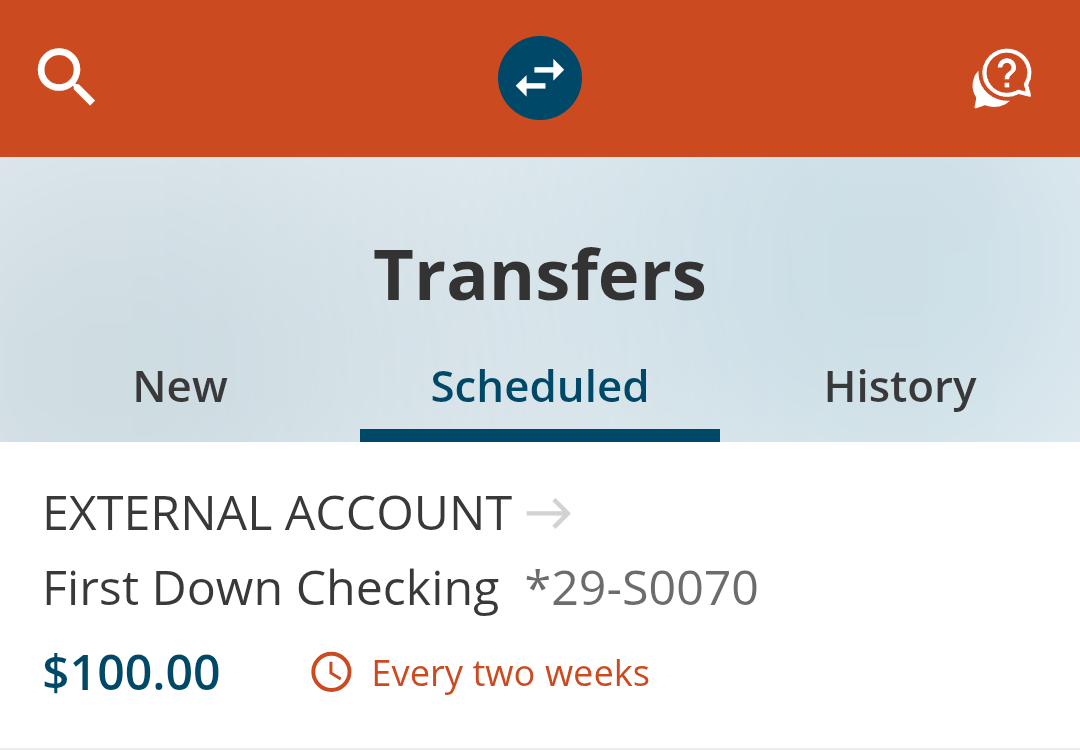

Transfer Money

Transfer Money

Schedule one-time or recurring transfers and payments between your accounts. Learn More ⇒

Pay My Bills

Pay My Bills

Schedule payments to a person, company, or financial institution with Bill Pay.¹ Learn More ⇒

Member to Member Transfers

Member to Member Transfers

Transfer money to another FCCU member by adding them as a Member to Member Account. Learn More ⇒

Get Started

#1 Navigate to Digital Banking

Online Banking

Online Banking

From a browser, navigate to the digital banking login page by clicking the blue Online Banking button at the top right of any page on our website.

Mobile Banking

Mobile Banking

![]() iOS iPhone Users

iOS iPhone Users

Download the app from the App Store.

![]() Android Users

Android Users

Download the app from the Google Play Store.

#2 Log In or Register

Business Users

Business Users

Click the Or, Register with Online Banking button. Follow the prompts to verify your identity (via email or text) and make a username and password.

IMPORTANT:

IMPORTANT:

- All business accounts will need to be re-registered to gain access to the enhanced business experience.

- Only one authorized user on the business account should complete this registration process. This user will be considered the "primary user" and will be able to add additional users with custom permissions from the account dashboard.

- If you have multiple business accounts at FCCU, you will need to complete this registration process to create login credentials for each individual business account.

#3 What To Do First

Here's a list of things we think you should check out first: from settings you'll need to reset to new features to discover!

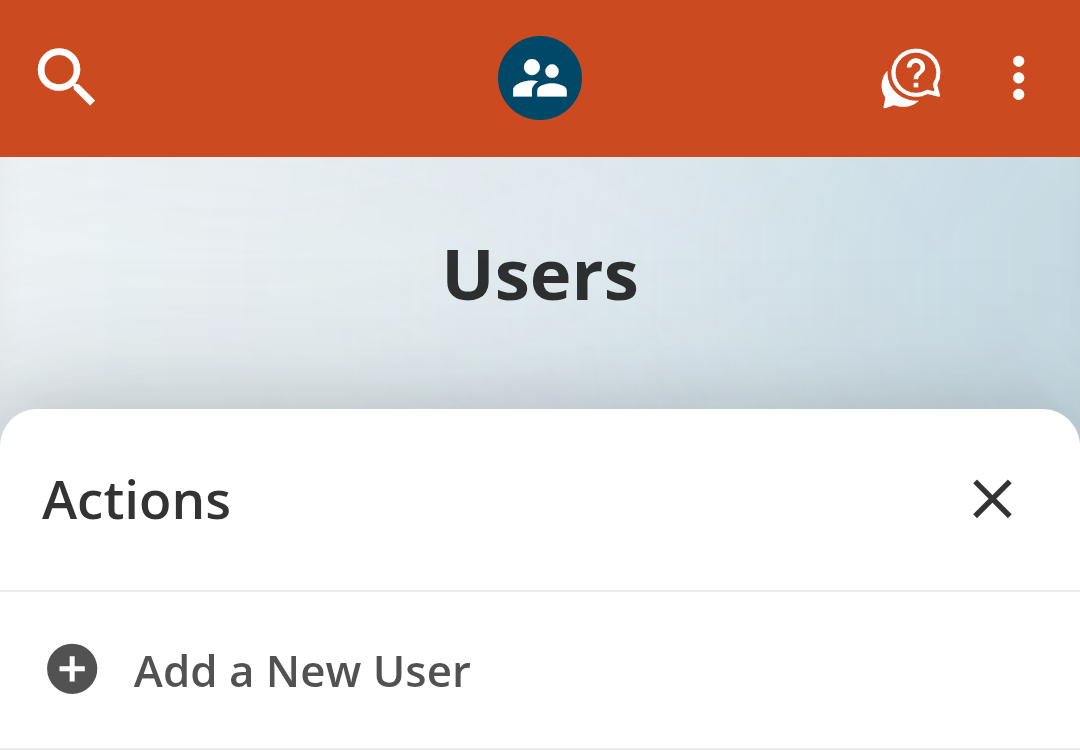

Create Custom Roles & Add Additional Users

Add additional Users to your business account while maintaining account security, minimizing financial risk, and establishing strong checks and balances.

For example, you may want to extend digital banking access to your accounting team to manage payroll transfers, pay bills, etc. Simply create a new Role with permissions based on accounts, transfers, ACH, wires, and more, and then add individuals as a new User.

Double Check Your External Accounts & Transfers

Your External Accounts and scheduled transfers should carryover, but we still encourage you to ensure that they are still set up properly after the upgrade.

Add Business Profile to Personal Account

Easily switch between your personal and business accounts without having to log in and out. Within settings, click the Manage Other Profiles option and follow the instructions.

Step-by-step instructions coming soon!

{openTab}

Pay your monthly bills securely within Online Bill Pay!1 Online Bill Pay is available within both Online & Mobile Banking. More info coming soon.

Features

Schedule Bill Payments & Transfers

Schedule automatic recurring or one-time payments to a person, company, or financial institution.

Set Up eBill

Participating payees may allow you to set up eBill to receive your recurring bills directly into Online Bill Pay.

Track Your Bill Payment History

With all your bills paid in one place, you can easily reference your bill payment history.

Set Up Payment Reminders

Set up email and/or text alerts to remind you when bills arrive electronically and when payments are due.

{openTab}

Pay your monthly bills securely within Online Bill Pay!1 Online Bill Pay is available within both Online & Mobile Banking. More info coming soon.

Features

Schedule Bill Payments & Transfers

Schedule automatic recurring or one-time payments to a person, company, or financial institution.

Set Up eBill

Participating payees may allow you to set up eBill to receive your recurring bills directly into Online Bill Pay.

Track Your Bill Payment History

With all your bills paid in one place, you can easily reference your bill payment history.

Set Up Payment Reminders

Set up email and/or text alerts to remind you when bills arrive electronically and when payments are due.