What's New?

This October, we gave our digital banking platform a face lift! Enjoy all the features you know and love in your current digital banking experience, plus a few new bells and whistles designed to make your financial life easier:

Holistic Account Management

Connect your accounts from other financial institutions to see your full financial life in one place.

Financial Wellness Tools

Access a suite of financial wellness tools including savings goals, budget tracker, and more!

Customize Your Experience

View accounts and features on your dashboard in the order that works best for you.

Track Spending Habits

Tag transactions to help keep track of spending, and create customized reports to monitor financial activity.

Self-Service Tools

Save time with new tools to submit a travel notice, set up overdraft protection, intiate a stop payment or wire transfer, and more!

Banco en español o inglés

¡Cambia entre español e inglés con sólo un clic! Switch between Spanish and English with just one click!

Financial Wellness Tools

Spending Analysis

Simplify how you track your spending. Filter by account, category, and time range. Plus, connect your other bank accounts to see everything in one place!

Savings Goals

The best way to save is to make a plan. Create a custom savings goal and track your progress as you make deposits before your target goal date.

Spend Forecast

When you know better, you can do better. Analyze your spending habits, identify trends, track bills and subscriptions, and more. Plus, connect your other bank accounts to see everything in one place!

Core Features

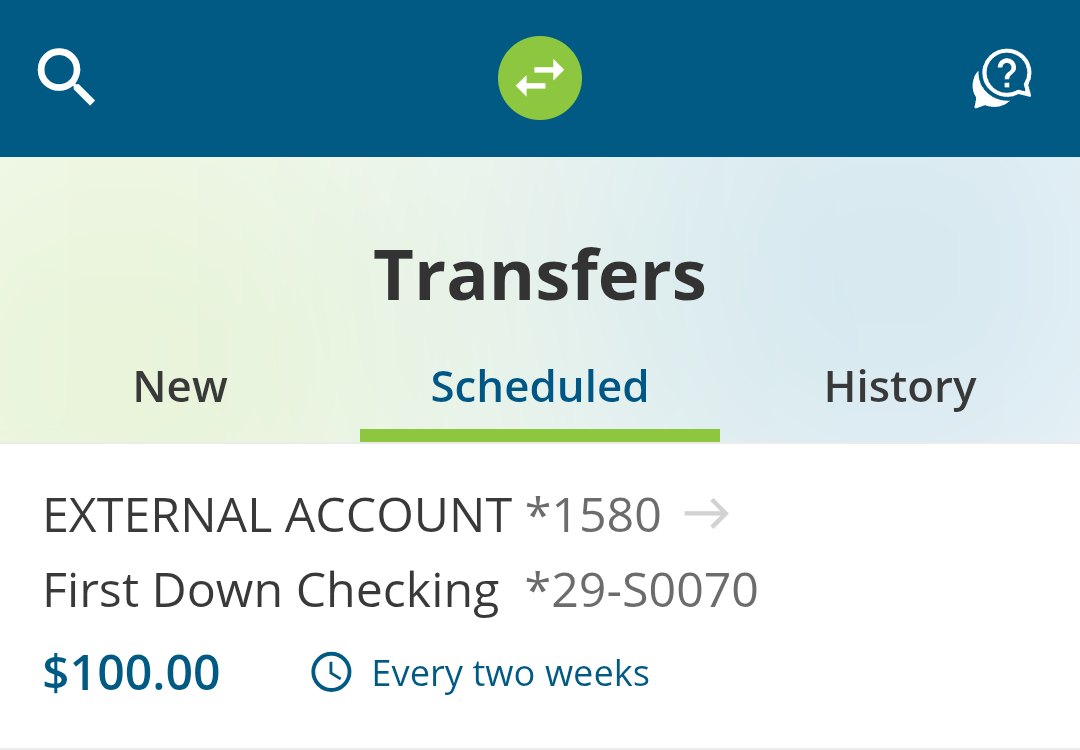

Transfer Money

Transfer Money

Schedule one-time or recurring transfers and payments between your accounts. Learn More ⇒

Member to Member Transfers

Member to Member Transfers

Transfer money to another FCCU member by adding them as a Member to Member Account. Learn More ⇒

Pay My Bills

Pay My Bills

Schedule payments to a person, company, or financial institution with Bill Pay.¹ Learn More ⇒

Credit Score & More

Credit Score & More

Access free credit monitoring tools including your daily credit score and more. Learn More ⇒

Get Started

#1 Navigate to Digital Banking

Online Banking

Online Banking

From a browser, navigate to the digital banking login page by clicking the blue Online Banking button at the top right of any page on our website.

Mobile Banking

Mobile Banking

![]() iOS iPhone Users

iOS iPhone Users

Download the app from the App Store.

![]() Android Users

Android Users

Download the app from the Google Play Store.

#2 Log In or Register

Returning Users

Returning Users

Log in with your username and password. Follow the prompts to verify your identity (via email or text) and make a new password.

New Users

New Users

Click the Or, Register with Online Banking button. Follow the prompts to verify your identity (via email or text) and make a username and password.

Business Users

Business Users

All business accounts will need to be rregistered by only one authorized signer. See instructions for more important details for business users.

#3 What To Do First

Here's a list of things we think you should check out first: from settings you'll need to reset to new features to discover!

Double Check Your External Accounts & Transfers

Your External Accounts and scheduled transfers should carryover, but we still encourage you to ensure that they are still set up properly after the upgrade.

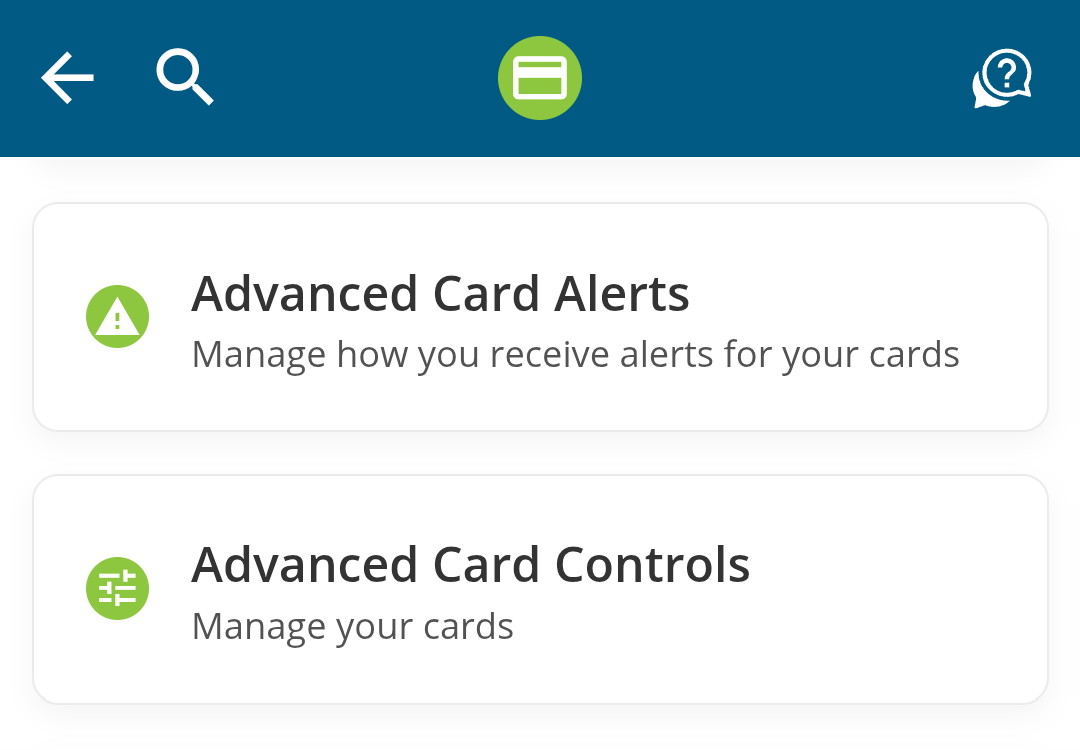

Set Up Alerts & Enhanced Security Features

Enable (or re-enable) email, text, and/or push notification account and security alerts. Get custom alerts about account balances, purchase activity, loan reminders, and more!

Plus, check out our whole new suite of card services including advanced card alerts and controls. Limit how your cards can be used by region, merchant type, transaction type, spending limits, and more!

Register for Advanced Card Controls

About Credit Card Alerts

{openTab}

Pay your monthly bills securely within Online Bill Pay!1 Online Bill Pay is available within both Online & Mobile Banking. More info coming soon.

Features

Schedule Bill Payments & Transfers

Schedule automatic recurring or one-time payments to a person, company, or financial institution.

Set Up eBill

Participating payees may allow you to set up eBill to receive your recurring bills directly into Online Bill Pay.

Track Your Bill Payment History

With all your bills paid in one place, you can easily reference your bill payment history.

Set Up Payment Reminders

Set up email and/or text alerts to remind you when bills arrive electronically and when payments are due.

{openTab}

An E-Statement is an electronic version of your bank statement that replaces the paper statement mailed to you each month.

With E-Statements, you'll receive an email notification each month when your statement is available to view securely within Online & Mobile Banking, under the Documents &s; Statements menu option. No sensitive information is emailed to your inbox.

Benefits

Increased Security

Paper statements could be lost or stolen in the mail, your home, or the trash. E-Statements allow you access to your statements within our secure digital banking platform.

Instant Access

Access all of your e-statements 24/7 within Online & Mobile Banking. Plus, you can download or print your statements if the need arises.

Positive Environmental Impact

Eliminating the need to print and mail your monthly statements is a small, but impactful way you can help us reduce waste over the lifetime of your membership.

Save Money

With E-Statements, you'll skip the $3 per month paper statement fee (waived for members under 18 and over 65).

Aside from E-Statements, you can access real-time account data 24/7 within Online & Mobile Banking. The information available within digital banking is identical to what's on your statement— but without the month delay.

Make budgeting easier by filtering account data by keywords, categories, or date to find exactly what you're looking for. Plus, you can download account data to use in apps like Quickbooks, Excel, etc. with various file formats (CSV, OFX, QBO, QFX).

Note: To comply with financial regulations, FCCU is required to have you accept the terms and conditions for E-Statements on each account individually. If you have more than one account at FCCU, be sure to check that all accounts are enrolled in E-Statements from the Documents & Statements menu option.

[1] Member must opt-in to Online Bill Pay within Online Banking. Fees may apply, see fee schedule.

[2] Active is a login within 30 days of year-end.