Build Your Savings Automatically

It’s pay day and you see that sweet, sweet paycheck direct deposited into your checking account. You run through your list of bills, make payments, and stare at the amount leftover.

What do you do with it?

Most people will just let it sit there and pull from it as expenses come up. No harm, no foul. You earned that money, and therefore you can spend that money how you see fit.

But what if I told you there’s something better you could do each payday? Well, technically you don’t have to DO anything.

By setting up a direct deposit split or recurring transfer, you could build yourself a thriving savings account a little at a time over time— AUTOMATICALLY.

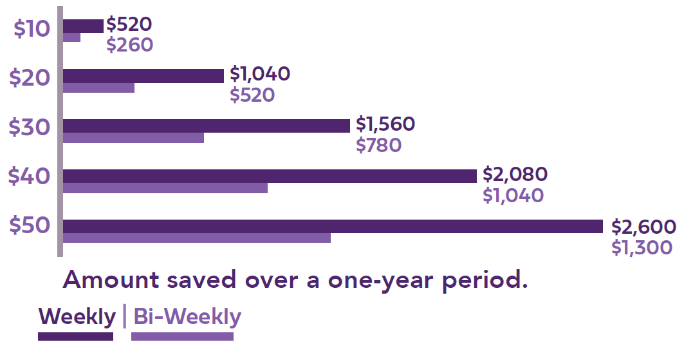

Automatically saving just $20 a paycheck could save you $520 in a year. That’s $520 you could spend on whatever your heart desires:

- A weekend getaway with your partner

- A comfy new chair and side table

- Far too many plants (I’m looking at you, mom)

- *fun police incoming* An emergency fund— Here’s 38 reasons you need at least a $500 emergency fund

If you’re not in a place to save $20 a paycheck, try $10 or even less. ANY amount will add up over time and help you build yourself a nest egg.

Up for a challenge? Save more! Check out this chart on how automatically saving $10 to $50 can add up over a year.

You can save automatically with both your employer and financial institution. The choice is yours!

Set up a direct deposit split with your employer

Each employer has a different process for setting up a direct deposit split, so I suggest contacting your payroll representative for a direct deposit form (or other instructions).

Some employers even provide the ability to adjust direct deposit splits via their online payroll platform.

Set up a recurring transfer with your financial institution

Alternatively, you could set up a recurring transfer with your financial institution. This is especially great for workers who are still paid via physical paycheck.

Within your financial institution’s online banking or mobile app, initiate a normal transfer. Then, see if there are options for “frequency” and “transfer/send date.” Use these fields to schedule automatic recurring transfers shortly after your paycheck is deposited.

*not so subtle plug* If you’re an FCCU member, you can use the FCCU Mobile App to set up recurring transfers.

No matter how much you save each paycheck— and no matter how you go about doing it— saving a little at a time over time is the best way to reach your savings goals.

Take the responsibility off your shoulders each payday by setting up a direct deposit split or recurring transfer to save automatically and build your savings account.

If you’re looking for “a sign” to start saving, this is it! Get to it!